- 101, Vasundhara Pride, Near Daffodils School, Laxman Nagar, Balewadi, Pune – 411045

- +91 74 14 99 9070

Labour Code 2025: A Financial Advisor's Guide to India's Historic Labour Reform

Posted by Acutus Business Advisors LLP

Your Partners in Financial Growth & Compliance Management

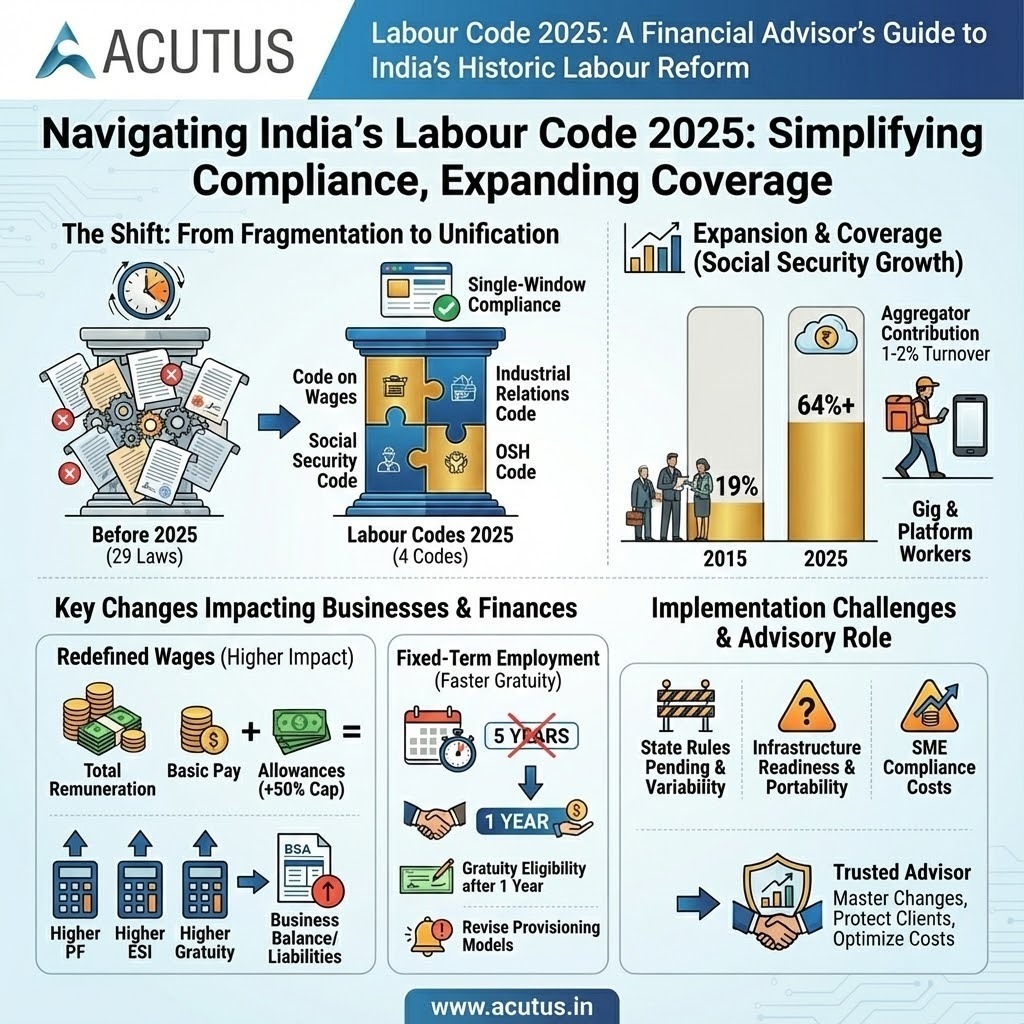

November 21, 2025, marked a watershed moment in India’s labour jurisprudence. The implementation of four Labour Codes, consolidating 29 fragmented central laws, represents the most comprehensive labour reform since Independence. For financial advisors guiding clients on compliance and payroll restructuring, understanding these changes is imperative.

Purpose: Simplification with Expansion

The Labour Codes aim to simplify compliance while expanding social security coverage. The four Codes replace overlapping legislation with unified frameworks, promising single-window compliance and standardized filing. Social-security coverage has increased from 19% in 2015 to over 64% in 2025, now including gig and platform workers.

Key Changes Impacting Businesses

Redefined “Wages”: Allowances exceeding 50% of total remuneration now count as wages, directly increasing PF, ESI, and gratuity calculations—impacting both employer costs and employee contributions.

Fixed-Term Employment: These workers now qualify for gratuity after one year, not five, requiring immediate revision of provisioning models.

Expanded Coverage: Gig workers, platform workers, and unorganised sector employees are now covered, with aggregators contributing 1–2% of annual turnover.

Effects: Financial Impact

The wage redefinition will reduce take-home pay while increasing statutory contributions. Employers must revamp salary structures, recalculate provisions, and monitor contract labour thresholds monthly.

Implementation Challenges

Despite progressive intent, significant hurdles exist: state rules remain pending, creating dual compliance environments; state-level variability in notifications continues; and infrastructure readiness for seamless portability remains inadequate. SMEs face particularly high compliance costs.

Ready to Navigate Labour Code Compliance?

As trusted advisors, financial professionals must master these changes to protect clients from penalties and optimize compliance costs. Need expert guidance on Labour Code compliance or payroll restructuring?

Contact us today for a comprehensive review tailored to your business needs.