- 101, Vasundhara Pride, Near Daffodils School, Laxman Nagar, Balewadi, Pune – 411045

- +91 74 14 99 9070

Game-Changing GST Reforms: What Every Business Owner Needs to Know

Posted by Acutus Business Advisors LLP

Your Partners in Financial Growth & Compliance Management

The recent GST Council decisions mark the most significant tax reform since GST’s launch in 2017. If you’re running a business in India, these changes will directly impact your bottom line, pricing strategy, and competitive positioning.

The Revolutionary Simplification

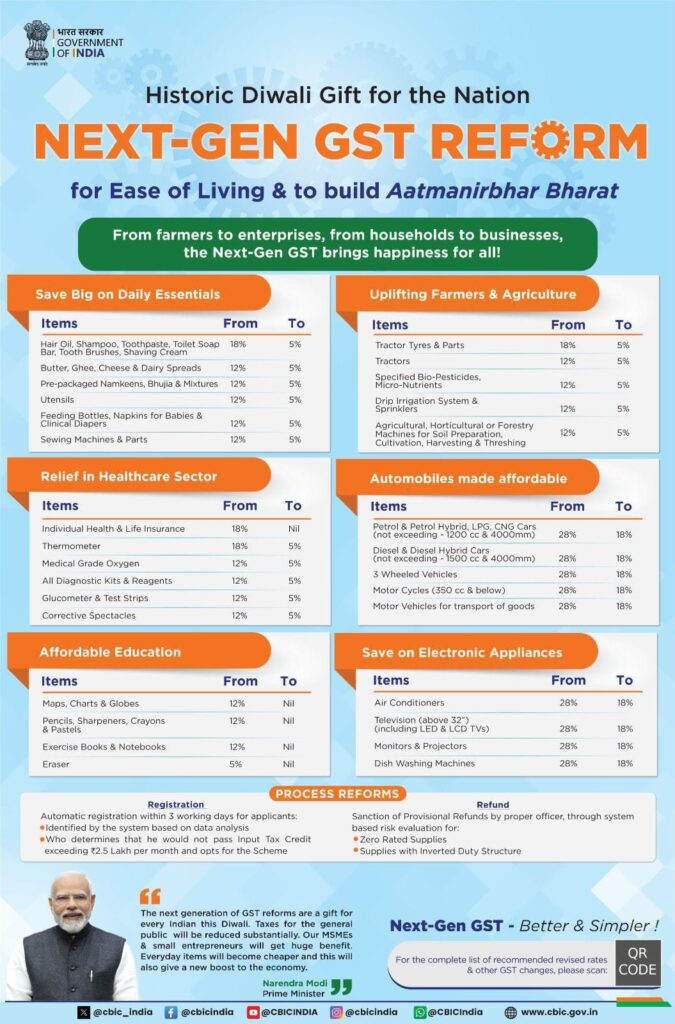

India has boldly moved from a complex four-slab GST structure (5%, 12%, 18%, 28%) to a streamlined two-tier system with primary rates of 5% and 18%. This isn’t just policy jargon – it’s a fundamental shift that will reshape how you do business.

Direct Impact on Your Business Operations

Immediate Cost Savings: Your business will benefit from reduced GST rates on everyday items. Products like hair oil, toilet soaps, shampoos, toothbrushes, toothpaste, bicycles, and kitchenware now attract just 5% GST instead of the previous 12-18%. For retailers and FMCG companies, this means improved margins and the ability to offer more competitive prices.

Zero Tax Benefits: Several essential items now carry zero GST, including UHT milk, packaged paneer, and Indian breads. If your business deals in food processing or retail, this opens up significant pricing advantages.

Supply Chain Advantages: Lower input costs mean better working capital management. Your procurement costs will decrease, creating opportunities to either improve profitability or pass on savings to customers for market expansion.

What This Means for Different Sectors

Manufacturing & FMCG: Lower input taxes translate to better margins and pricing flexibility. You can now compete more aggressively without compromising profitability.

Retail & E-commerce: Reduced GST on consumer goods means you can attract price-sensitive customers while maintaining healthy margins.

Food & Beverage: With several food items moving to nil or lower tax brackets, F&B businesses can explore new product lines and pricing strategies.

Service Providers: The simplified structure reduces compliance complexity, freeing up resources to focus on core business activities.

Strategic Opportunities to Capture

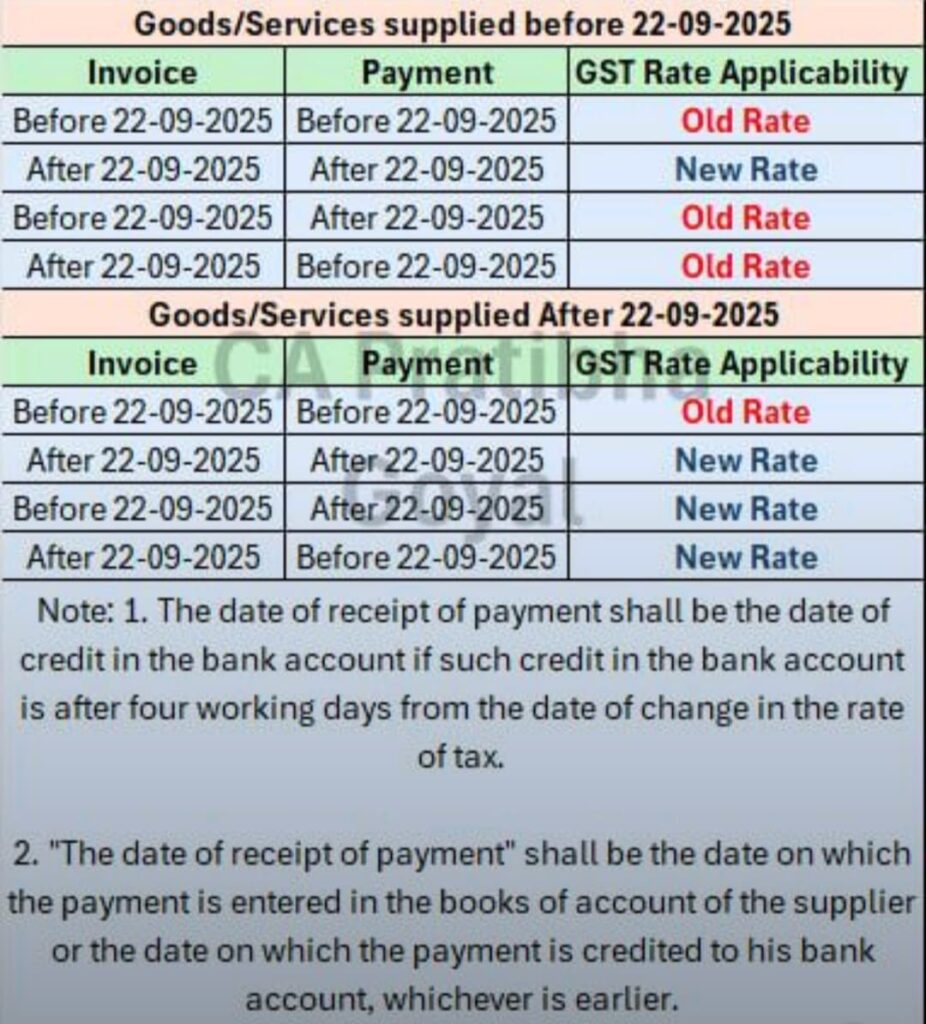

- Repricing Strategy:Review your pricing models immediately. The rate changes effective September 22, 2025, offer a window to gain market share through strategic pricing.

- Inventory Management:Plan your inventory purchases around the implementation dates to maximize benefits from lower tax rates.

- Customer Communication:Proactively communicate these savings to your customers. Transparency about passing on GST benefits builds brand loyalty.

- Vendor Negotiations:Renegotiate contracts with suppliers who will benefit from lower input taxes. Ensure you’re getting your fair share of the savings.

Preparing Your Business for Transition

The implementation begins September 22, 2025. Here’s your action checklist:

- Update Systems: Ensure your billing software and ERP systems are configured for new rates

- Train Your Team:Staff handling billing, procurement, and customer queries need immediate training

- Review Contracts: Examine existing agreements for tax escalation clauses that may need adjustment

- Cash Flow Planning: Lower tax outgo improves cash flows—plan your working capital strategies accordingly

The Bigger Economic Picture

These reforms signal India’s commitment to becoming a manufacturing hub. Reduced tax burden on essential goods means higher disposable income for consumers, driving demand across sectors. For businesses, this creates a virtuous cycle of growth opportunities.

The government has essentially reduced the cost of doing business while maintaining revenue adequacy—a win-win that positions India as an increasingly attractive destination for both domestic and international businesses.

Seize the Moment

Tax reforms of this magnitude don’t happen often. Businesses that act swiftly to capitalize on these changes will gain significant competitive advantages. Whether you’re a startup or an established enterprise, these GST reforms present an opportunity to accelerate growth while improving operational efficiency.

The new tax structure is simpler, more business-friendly, and designed to fuel economic growth. The question isn’t whether these changes will impact your business—it’s how quickly you can position yourself to benefit from them.

How is your business preparing for these GST changes? What opportunities do you see in your sector? Let’s discuss…